Major national survey uncovers the true role that the UK’s print, paper, packaging, labelling, and graphics sectors play within UK economy

Earlier this year, the Graphic and Print Media Alliance (GPMA) launched a major national survey to uncover the true role that the UK’s print, paper, packaging, labelling, and graphics sectors play within the country’s industrial ecosystem.

The message was clear: while often operating behind the scenes, the print industry is far from peripheral. It is a strategic enabler of productivity, compliance, innovation and economic resilience across some of the UK’s most vital manufacturing and strategic sectors.

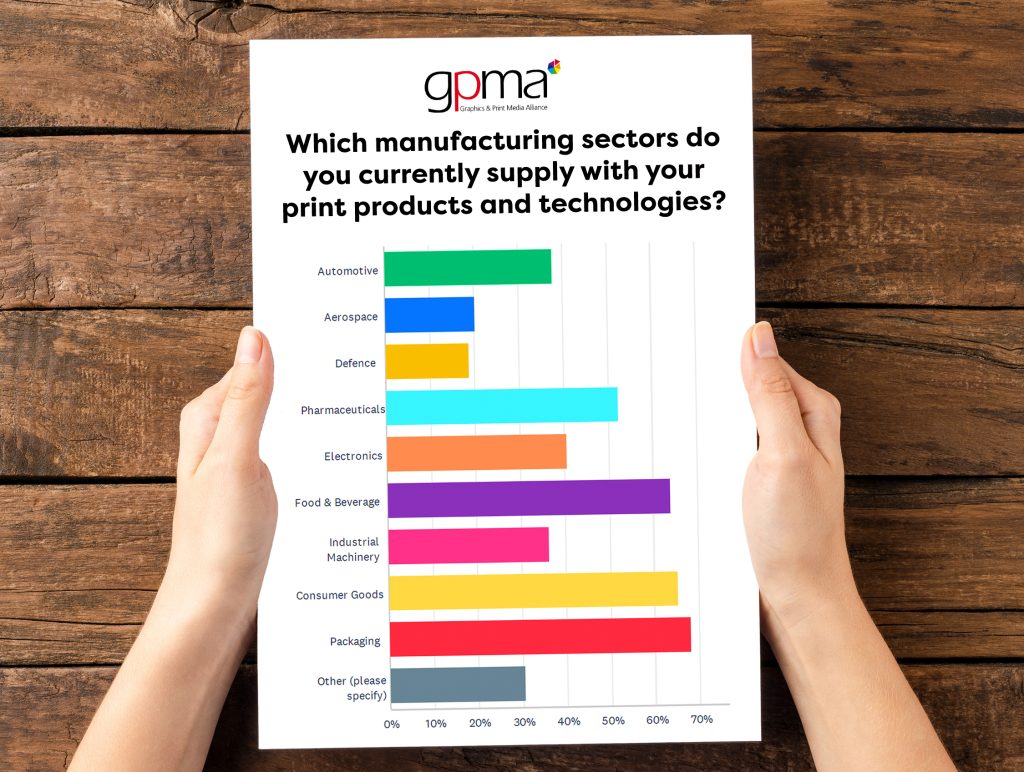

The research reveals that print businesses are intricately embedded in the UK’s industrial supply chains, serving sectors as diverse as pharmaceuticals, food and beverage, consumer goods, automotive, aerospace and defence. Marketing materials remain the most supplied application (64 percent), closely followed by packaging and labelling (56 percent), technical documentation, safety signage, and increasingly — functional print solutions like printed electronics and anti-counterfeit technologies.

More than half of all respondents (52 percent) stated that their print solutions were “extremely critical” to the sectors they serve — with a further 38 percent describing them as “very important,” often underpinning compliance, branding, and traceability functions. This aligns with a broader finding: many manufacturers simply could not operate without the products and services supplied by the print industry.

An integral cog

When asked about supply to the defence sector, nearly one in five businesses (19 percent) confirmed ongoing active involvement, either directly or through partners while 43 percent have previously supplied the defence sector directly or through its supply chain.

While the majority of these engagements were under £250,000 in annual contract value, nearly one in ten reported contracts exceeding £1 million, highlighting the often under-recognised role of print in supporting national security, logistics and mission-critical documentation.

Despite this deep integration, the industry still battles with visibility. Just 42 percent of respondents said their clients fully recognised them as critical partners in their supply chains. A further 39 percent felt they were valued, but not fully understood; suggesting a communications gap that the GPMA’s advocacy seeks to address. This is compounded by the wider perception: over 40 percent of those surveyed believe that policymakers and manufacturing leaders lack a full understanding of print’s contribution to industrial success.

However, the findings also point to growing opportunities, as 60 percent of respondents reported increased strategic engagement from high-value sectors, particularly in pharmaceuticals, advanced manufacturing, and packaging innovation. Cost efficiency, compliance, digital transformation, and short-run customisation were all cited as key drivers of value.

The GPMA has now used these insights to provide a compelling evidence base to the Department for Business and Trade, intended to help inform future policy, investment priorities, and industrial strategy. It is a timely reminder that if the UK is serious about reindustrialisation, it must invest in the foundational sectors – like print – that make it possible.

IPIA reveals print industry research to help drive growth

Roland highlights “Packaging Roulette” in World Sight Day research