Packaging Innovations & Empack looks at how the budget of 2025 is being received across the print and packaging sector.

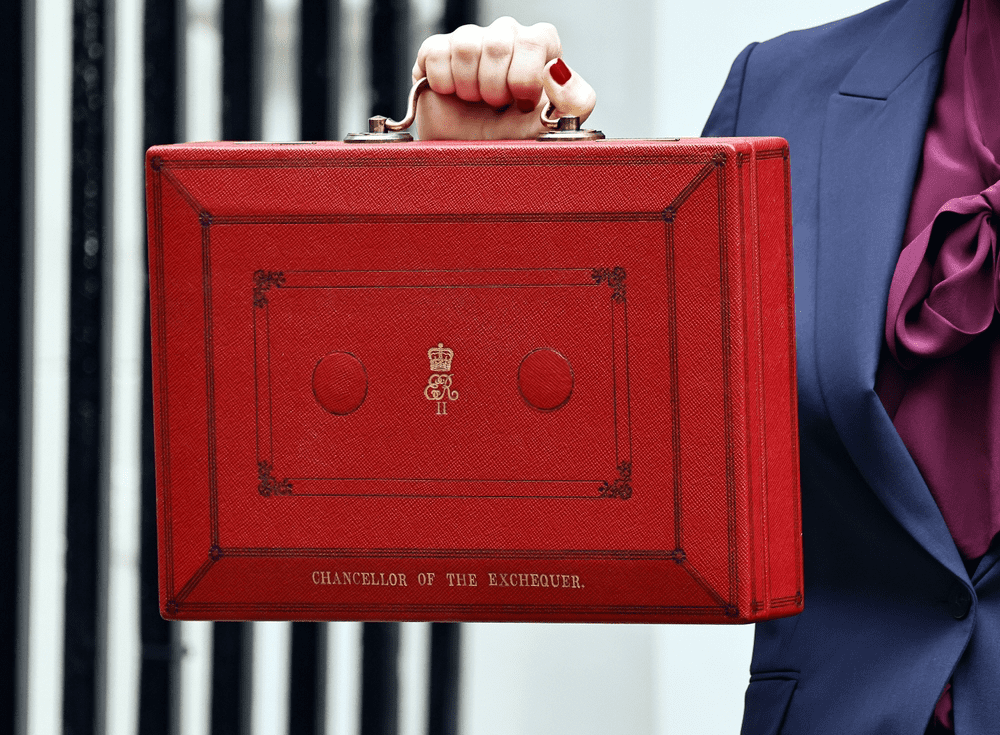

The autumn budget of 2025 has landed, and the print and packaging sector is now assessing the implications of a fiscal statement that delivered both expected measures and a few unwelcome surprises. As Chancellor Rachel Reeves outlined a programme shaped by “necessary choices,” industry leaders immediately turned their attention to what the announcements mean for cost pressures, regulatory obligations, and investment plans in the year ahead.

The budget breakdown

In the buildup to the budget, much of the national debate centred on the career prospects of the Chancellor and her party leader. The packaging industry cannot afford to indulge in Westminster psychodrama, however – for a sector already balancing rising material prices and intensifying sustainability demands, the reveal of the budget must be met with a rapid response.

Much of the immediate reaction has centred on the regulatory environment, particularly the increase to the Plastic Packaging Tax (PPT), which was confirmed to rise in line with inflation. With the rate already standing at £223.69 per tonne and applied to almost 5,000 registered businesses, the tightening of recycled-content requirements comes at a time when recycled polymers remain more expensive than virgin material and domestic recycling capacity continues to contract. The budget’s shift towards a higher recycled-content threshold, combined with signals of a longer-term tax trajectory, has intensified concerns around rising overheads and the widening gap between policy ambition and on-the-ground infrastructure.

More warmly received was the announcement of a £1.5bn skills package aimed at tackling the UK’s entrenched labour shortages and sluggish productivity. This will see apprenticeships, digital training, employer incentives, and AI-focused programmes brought together under a single, more targeted framework. This is aimed at closing skills shortages across engineering, manufacturing, construction, health, and the AI sector.

While many headlines focus on the measures that are in the budget, some measures are attracting attention for their absence. Notably, the plan to reform landfill tax by scrapping its lower rate was dropped, as the government seemingly listened to concerns raised by the construction and waste management sectors. This has significant implications for the packaging waste stream, but it will also benefit businesses looking to build new facilities in the UK.

Another proposal that did not make its way into the red briefcase is a progressive PPT escalator to raise the recycled-content threshold from 30% to 50% over this Parliament, backed by a clearer long-term tax roadmap. Many stakeholders argue that this is essential to stabilise the market and stimulate demand for high-quality UK-reprocessed plastics.

To capture the full picture of how the sector is responding, Packaging Innovations & Empack 2026 invited leaders from across print, packaging, recycling, materials, and design to share their immediate reactions, offering a candid, cross-industry view of what the Budget gets right, what it has overlooked, and where businesses now go next.

Here’s what they said…

Thomas Glendinning, Managing Director at Sovereign Labelling Machines, supplier of labelling and sleeving solutions:

“More needs to be done to address the skills gap that is evident in printing, packaging, and manufacturing more generally. I would like to see more pronounced measures that support British manufacturing. These are both obvious things that haven’t been happening.

“On the other hand, with the further rise of the national minimum wage, I’m hoping we can capitalise on this by helping our clients/potential clients to introduce more automation and ward off a hike in wage bills.”

Robbie Staniforth, Innovation and Policy Director at Ecosurety, packaging compliance expert:

“Sadly, there wasn’t enough in today’s budget to support the recycling and reuse of packaging in the UK. EPR alone will not drive the systems change required. We need more fiscal instruments from the Government over the next decade if we are to support the brilliant reprocessors and reuse systems of this country.”

“The fact the Government still thinks in terms of a Consumer Price Index indicates just how far we have to go on the transition to a circular economy. Consumption is an outdated term from a linear world created by marketeers to sell more products. We are citizens of the planet that simply use resources, and hopefully return them to nature. When will we see a budget that encourages us to ‘consume’ less? The wait continues.”

IOM3 Chief Executive Dr Colin Church CEnv FIMMM said:

“We are at a pivotal moment in UK policy development, and the vital role of materials, minerals and mining is unmistakably clear – from the government’s Industrial Strategy and recently published Critical Minerals Strategy, to the forthcoming Circular Economy Growth Plan for England. It is essential that the government’s economic priorities enable effective delivery across these areas and support the step change required to transition the UK to a low-carbon, resilient and resource-efficient society.

“It is, therefore, disappointing not to see greater recognition of our key industries and the value they bring in today’s budget speech. However, the emphasis on supporting businesses to develop in the UK and ongoing investment in clean energy and advanced materials is welcome.”

Gillian Garside-Wight, Director of Consulting at Aura, packaging strategist and consultant:

“The autumn budget signals a challenging period for businesses, including the packaging sector. With income tax thresholds frozen until 2031 and overall tax take projected to hit 38% of GDP by 2030, consumer spending power may tighten. This could drive greater demand for private-label value ranges, while premium brands may see a decline as shoppers adjust to reduced disposable income. Rising costs could pressure margins across the entire value chain.

“For packaging specifically, the budget confirms that PPT rates will increase in line with CPI inflation from 2026–27, maintaining financial incentives to incorporate recycled content. In addition to a consultation on mandatory certification for mechanically recycled packaging in early 2026, a critical development for businesses seeking PPT exemptions. Companies must prepare for stricter compliance requirements, requiring more granular packaging data, associated certifications, and potential audit processes.

“The broader economic outlook, with downgraded growth forecasts, means efficiency and innovation will be key. Ethical sourcing, reducing virgin material use, and investing in recycling infrastructure will not only mitigate costs but also align with sustainability expectations.

“Businesses should review their exposure to PPT and collect more granular packaging data in order to stay compliant and limit any future liabilities. They should also redouble their efforts to secure recycled material streams by collaborating with suppliers. This kind of proactive compliance will enable businesses to build resilience, and it’s this that will define success in the coming months.”

Karen Betts, Chief Executive, The Food and Drink Federation (FDF):

“Food and drink manufacturing employs half a million people in communities across the UK and, as responsible employers, we want to ensure our colleagues are rewarded properly. However, we’re concerned that the changes to salary sacrifice for pension contributions will discourage people from adequately saving for their retirement, creating further costs for the State down the line. “It’s good news the government has committed to legislating for mass balance accounting in this Finance Bill. This means that companies using mechanically or chemically recycled plastic will no longer have to pay as much in the plastic packaging tax. It’s also welcome that government will formally consult on the future of the costly, volatile and outdated Packaging Waste Recovery Notes (PRNs) system, and on ensuring councils run efficient, cost-controlled recycling services. To drive real change and value, it’s good to see government again acknowledging the key role of producers in leading the EPR scheme, through a Producer Responsibility Organisation.”

Luke Wilson, Owner & Managing Director of FACER, Leeds-based print and packaging company:

“I read today’s UK Budget with a pinch of cautious optimism and a fist full of realism. On the positive side, the announced support for business investment – including expanded capital-allowances and tax incentives aimed at SMEs – could encourage manufacturers to modernise equipment – vital for any UK SME packaging manufacturer.

“However, significant challenges remain – to an extent, many of which reside outside the influence of the government’s budget – however, some of which are not helped by it, such as rising labour costs stemming from increases in the minimum wage and in turn, the Real Living Wage, in order to combat the real issue, the rise in the cost of living. Along with continued pressure on employer contributions, which will only put further squeeze on long-term business viability, especially at a time when other operating costs remain incredibly high and incredibly uncertain such as energy.

“Ultimately, the Budget delivers a mix of support and fresh burden – not a game-changer and not surprising, a manageable backdrop that offers all manufacturers the same deck of cards to play with. For FACER, it reinforces the need to invest thoughtfully, tighten cost-control, continue to improve efficiency and remain incredibly agile in response.”

Managing director of a leading UK packaging manufacturer, who wished to remain anonymous:

“This chaotic budget shows no serious commitment to economic growth. It follows a familiar tax-and-spend approach that once again raises the cost base for businesses while actively discouraging investment and expansion.

“With the highest tax take in living memory, the message to enterprise is clear: Wealth creation plays second fiddle to redistribution. While there are one or two marginal measures that may offer limited benefit to parts of the packaging sector, these are overwhelmed by the negatives.

“Taxes on businesses and consumers at this level will inevitably stifle future growth. Freezing income tax thresholds, further increases to the National Minimum and Living Wage, higher dividend taxes, changes to EOT taxation, and reduced capital allowance write-downs all undermine confidence and restrict the ability of businesses to reinvest. While the £1 million Annual Investment Allowance remains and employer National Insurance has not risen again, this is a budget that leaves businesses relieved it was not worse rather than motivated to grow.”

Chris Jordan, Partner Founder at Exedrabridge, a print and packaging industry consultant:

“Rachel Reeves managed not to upset the market, and particularly the bond traders. Then she kept Labour MPs on side, and as was expected, did some good things for those that are not so well off.

“Her options are limited partly because of her fiscal rules, but far more by external factors and the state of the UK’s finances. The global headwinds are extremely unpredictable, and I will be surprised if there is not another major shock in the near future.

“There was nothing I saw as particularly damaging to print, packaging, and design in the budget. The opportunities and challenges are two sides of the same coin. Those who are happy with change, can pivot, anticipate, and play what’s in front of them, and those who know how to sell and market themselves will reap the benefits. The huge majority, however, cannot, and so decline will continue. Add to this that the UK’s competitiveness and productivity are appalling, and the result is almost inevitable.”

Caroline Wiggins, Chief Executive at eGreen, sustainable tableware manufacturer:

“Tax and more tax! That isn’t good for consumers or business. Everything from pensions to milkshakes have been taxed, adding to existing measures like the plastic packaging tax, EUDR, waste packaging levy – the list goes on.

“Not only do we have to pay all these taxes, we also have to carry out all the extra admin behind the scenes. That comes with its own costs. And as most food is packaged in one way or another, covering these costs will ultimately lead to an increase in consumer prices.

“In our sector, restaurants and pubs are finding it particularly tough. The British Beer and Pub Association says that one pub is closing every day, so the outlook was already challenging. Unfortunately, the budget didn’t deliver any good news for most people. I think the implications of it are more serious than people realise.”

Jo Stephenson, Managing Director at Think B2B Marketing, packaging industry marketing and communications specialist:

“As we look beyond the headlines of the Chancellor’s 2026 budget plans, the most important question for our industry is how the UK intends to grow. With the OBR now forecasting slower GDP growth at an average of 1.5 percent over the next five years, we should be doubling down on the sectors where Britain is already world leading. Packaging is one of the UK’s most advanced manufacturing strengths, innovating in materials, automation, recyclability and regulation. It deserves to be treated as a strategic and growth-driving industry.

“The new £1.5 billion skills package is encouraging, but the real test will be whether it reaches the industries that can deliver productivity gains fastest. For packaging, the biggest limiting factor is not invention but people; we need young engineers, designers and data specialists who see packaging as a high-potential career with real impact on sustainability and supply chains. That, in turn, requires stable long-term support for apprenticeships, technical training and partnerships between colleges, converters and brand owners. Higher taxes and frozen thresholds risk squeezing the very training budgets that build future talent, so it’s vital that the Government backs the sectors already proving that innovation, circularity and competitiveness can go hand in hand.”

Roger Wright, Waste Strategy & Packaging Manager at Biffa, recycling and waste management company:

“From the wider Biffa group point of view, the government’s decision not to converge the two rates of landfill tax before 2030 is a positive outcome for our industry. Ministers have listened to stakeholders and avoided changes that could have increased waste crime and tax evasion. Retaining the exemption for backfilling quarries will also help housebuilders deliver much-needed homes without additional costs.

“On packaging specifically, we welcome upcoming consultations on the Packaging Waste Recycling Note system and on mandatory certification for mechanically recycled plastic under future Plastic Packaging Tax reforms. These are essential steps to address fraud, strengthen market transparency, and pave the way for further improvements, including a ban on exports of unprocessed plastic waste.

“However, increasing the Plastic Packaging Tax in line with CPI inflation for 2026 to 2027 does not go far enough. We have long advocated for a progressive structure that makes virgin plastic more expensive than recycled material, and inflationary uplifts alone will not deliver that shift.

“A commitment to consult on key issues is encouraging, but future reforms must incentivise investment in recycling infrastructure and support the UK’s transition to a low-carbon, resource-efficient economy. Our latest Economic Impact Report highlights what is possible, for example, banning the export of unprocessed plastic waste could create more than 9,000 jobs and generate £900 million in annual economic output, without relying on public funding.”

As the fallout from another newsworthy budget continues, it’s never been more important to be part of the conversations driving the packaging industry forward. Packaging Innovations & Empack 2026 will put you at the heart of that conversation alongside hundreds of suppliers and thousands of brands and other businesses in attendance.